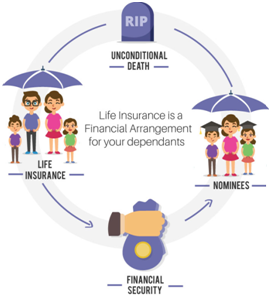

Life Insurance is the best source of providing a strong financial backup & support for your family after your unfortunate demise.

Life Insurance is an important part of a sound and structured goals based financial planning.

Different types of life insurance plans help you save in a well structured manner for important goals of life.

The principle behind life insurance is simple, in theory. It's also morbid, at least compared to other financial services. You pay small amounts at monthly intervals, so that when you die, a beneficiary of your choice gets a sum of money approximating what you would have earned had you stayed alive.

That's the stark truth right there, which a lot of life insurance customers fail to comprehend: the service is supposed to be nothing more than a replacement plan. The idea is that should your family suffer a crisis that transcends finances, at least their finances won't be impacted too negatively. If you die, your spouse and kids won't have to take on multiple jobs, beg for alms, nor lose the house and car.